Understanding rising insurance rates

Insurance rates have been rising over the last two years and we know that can be frustrating and confusing. After all, everyone at Grinnell Mutual is a policyholder, too. And it’s been an especially stressful, changeable, and uncertain few years for consumers and businesses alike.

There are many factors that affect overall rates, whether or not you’ve personally had a claim.

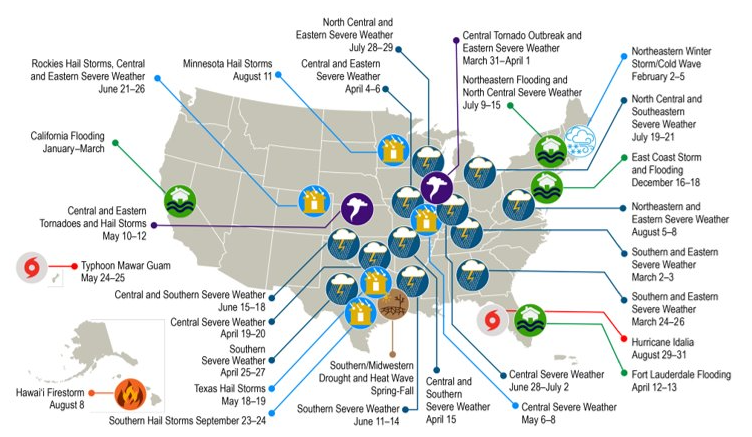

One of the main forces now — growing over the last handful of years and expected to continue into the future — is climate change. Climate change is leading to more — and more severe — weather events across the world.

More severe weather events have a domino effect. More tornadoes, derechos, hail, floods, and forest fires mean more property damage, which means more insurance claims overall. Which has meant, for most property-casualty insurers, more money being paid out than was collected in premiums.

This, in turn, requires insurers to dip into their “surplus,” a fund that regulators require insurers to keep at a minimum amount. In order to maintain that minimum amount, insurers must cut expenses and raise rates.

Source: NOAA

If you'd like more explanation about why your auto, home, and/or commercial insurance rates are going up, take a look at our simple, one-page explainer. Just interested in learning about auto rates? We have a resource for that, too.

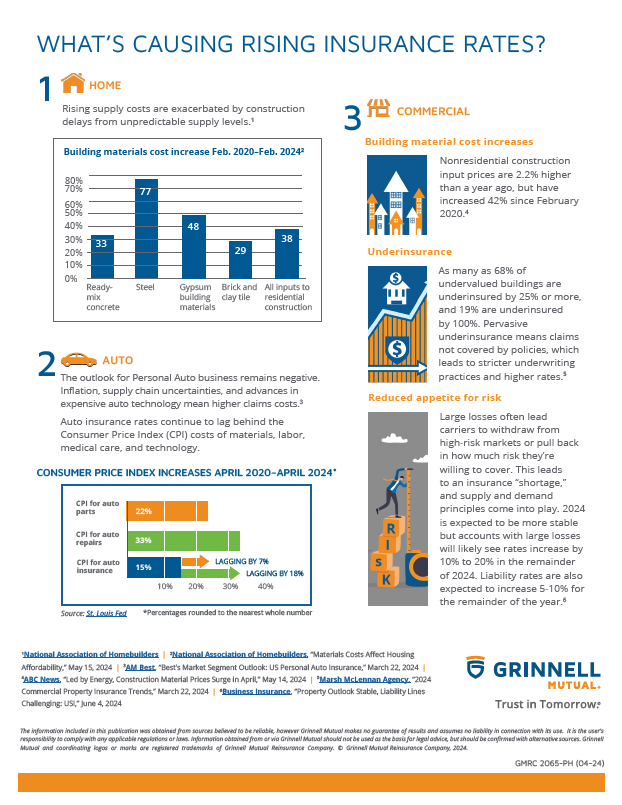

AUTO, HOME, COMMERCIAL

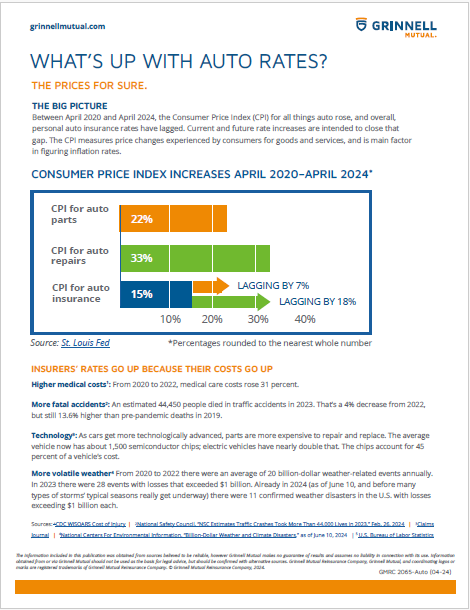

AUTO

The information included here was obtained from sources believed to be reliable, however Grinnell Mutual Reinsurance Company and its employees make no guarantee of results and assume no liability in connection with any training, materials, suggestions or information provided. It is the user’s responsibility to confirm compliance with any applicable local, state or federal regulations. Information obtained from or via Grinnell Mutual Reinsurance Company should not be used as the basis for legal advice or other advice.

6/2024