Surplus lines help fill the gap

Every epochal event has its economic winners and its losers — those who flourish and those who flounder, often as a result of things beyond their control.

This is certainly true in wartime, and it’s also true after large-scale natural disasters (especially as they pile up relentlessly, month after month, as they have over the last handful of years), and during a global pandemic that upends life all over the world.

Like the proverbial stone thrown into a pond, these events’ ripples — disrupted supply chains, knee-capped hospitality and travel industries, and generalized economic uncertainty — keep expanding, eventually reaching some shore or another.

Surplus risk = surplus lines

On the shore that is standard insurance carriers, uncertainty equals a rethinking of risk appetite. And when standard carriers start to pull back on writing certain risks, surplus lines carriers help fill the void by writing policies declined by standard carriers due to their unusual or high-risk nature.

The surplus lines market traditionally performs well during times of tumult and uncertainty. — AM Best market segment report

But it’s not just about world- and landscape-changing events. Plenty of risks taken on by non-standard carriers are less newsworthy, but far more common — lodging and boat rental, crane operators, corn mazes, class reunions, and snowplows for example.

These are everyday sorts of risks that many standard carriers prefer not to write. But big, unexpected events are where this particular market shines brightest.

According to a September 2021 market segment report from AM Best, “The surplus lines market traditionally performs well during times of tumult and uncertainty.” There’s been plenty of that.

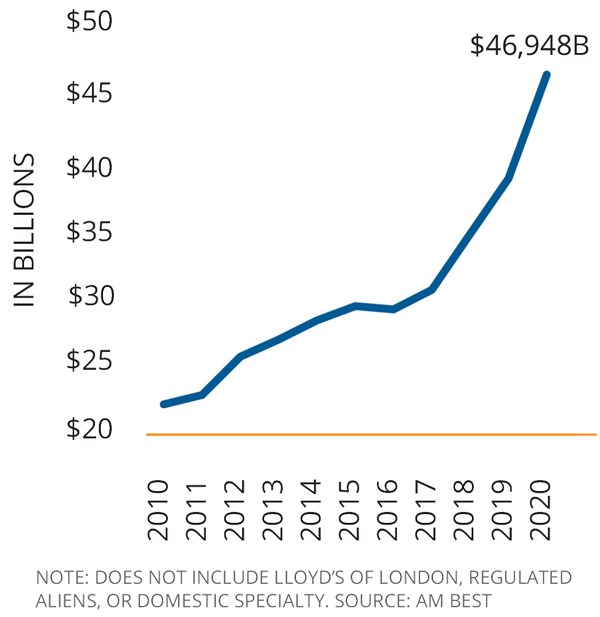

U.S. surplus lines (domestic professional)

“Think about the wildfire losses in California in 2019,” said Brady Kelley, executive director of the Wholesale & Specialty Insurance Association (WSIA). “Surplus lines carriers were already underwriting some of those catastrophic exposures, but the sheer volume

of the wildfires’ damage — in acres and homes and lives lost — changed the standard market’s risk appetite” for that type of coverage, leaving a larger coverage gap for surplus lines carriers to fill.

Which they do in a big way. According to AM Best’s report, direct written premium for U.S. surplus lines carriers topped $66.1 billion in 2020, a 17.5 percent year-over-year increase, the largest gain since 2003.

Because they’re regulated differently than admitted carriers, surplus lines (non-admitted) carriers are nimble and flexible — not only in their ability to pivot quickly, but to underwrite in more customized and innovative ways.

But it’s not the wild, wild west

That is not to say that surplus lines carriers are not regulated at all, or that doing business with these carriers is necessarily high-risk.

While non-admitted carriers do not have to submit rates, forms, or underwriting guidelines to states for approval, and do not have to contribute to the state guaranty fund as admitted carriers do, the brokers who sell their products must be licensed by the state and are therefore regulated by the state. And most states require surplus line brokers to prove they made a good faith effort to find coverage from authorized carriers before writing the business with a non-admitted carrier.

Despite a non-traditional regulatory approach, according to AM Best’s annual survey of the surplus lines market, the solvency record of surplus lines carriers is as good as, if not better than, the overall insurance industry. “As of mid-year 2021, 96 percent of surplus lines insurers had AM Best Long-Term Issuer Credit Ratings (ICRs) of “a-” or higher, compared with 78 percent for the total property-casualty industry… .”

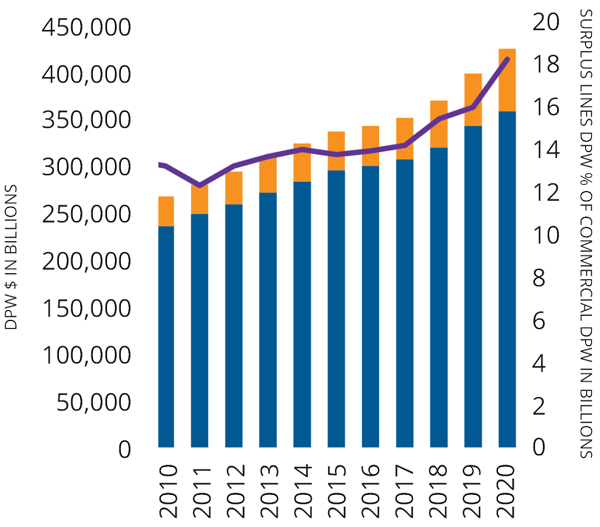

Surplus lines direct written premium as a percentage of property-casualty industry commercial lines (domestic professional)

Grinnell Specialty Agency

Grinnell Specialty Agency (GSA) is Grinnell Mutual’s in-house brokerage firm. The subsidiary of the Grinnell Mutual Group has helped agents who write for the company find coverage for hard-to-place risks — surplus lines — since 1975.

Mandy Hudnut, assistant vice president of GSA, says the brokerage offers a valuable service to Grinnell Mutual agents.

“By only working with Grinnell Mutual’s appointed agents, we help protect the agency’s book, so another agent can’t come in and try to take that business,” Hudnut said.

By only working with Grinnell Mutual’s appointed agents, we help protect the agency’s book.

— Mandy Hudnut, assistant vice president, Grinnell Specialty Agency

At the heart of it though, she said, the real benefit of using GSA comes with its commitment to relationships — the same focus that Grinnell Mutual has always had.

“Our goal is just to help them get what they need for their customers. When they work with GSA, they get a designated broker. And we’re a small enough team to build those relationships, but also a team with a lot of experience (a combined 100+ years) and access to a lot of markets,” she said. “Plus, we could potentially save a book of business, because if Grinnell Mutual won’t write it, we’re here to fill that gap.”

Risk coverage requests range from the simple (weddings) to the complex (directional boring) to just sort of weird (goat yoga).

The turnaround time on binding coverage varies accordingly, from within a day to a week-plus.

There were new businesses that were created during the pandemic conditions, falling right into that ‘new and unique’ risk that surplus lines have specialized in for many years. — Robert Raber, AM Best director

“What usually holds things up is getting declinations from companies. Then we just keep searching, going down our list of carriers,” Hudnut said. “I enjoy being able to help agents find a market when they have difficulty finding other options.”

Hudnut notes that while they still write risks that the company was founded to address — like aircraft- related coverages — “Our highest volume of business comes from general liability for special events,” like parades, festivals, and haunted houses, she said.

A strong future market

With the ever-shifting landscape of the pandemic and its lingering side effects, AM Best expects a decline

in standard carriers’ capacity and hardening rates for many commercial coverages, which “creates an environment with an acute need for creative market and product-oriented solutions — the hallmarks of the surplus lines carriers.”

In AM Best’s October 2021 webinar about the topic, Director Robert Raber said, “There were new businesses that were created during the pandemic conditions, falling right into that ‘new and unique’ risk that surplus lines have specialized in for many years.”

Even pandemic conditions notwithstanding, the market has been growing over the last three to four years, Raber noted. “Standard carriers are restricting their appetite for certain risks and classes of business,” he said. “That contraction in the admitted carriers’ appetite puts a fair amount of accounts in the [surplus lines] market. We’re…expecting this trend is going to continue through the year-end of 2021 and probably into 2022.”

The bottom line in AM Best’s recent report looks rosy.

“AM Best believes that, given the surplus lines market’s proven ability to effectively assess new exposures and its flexibility to tailor terms and limits to meet coverage demands, the market’s critical role and value to the property-casualty insurance marketplace will continue to grow.”

Hudnut agrees. “I think the surplus lines market will continue to grow and become even more needed, especially as businesses evolve along with world events. And climate change could have a big impact as losses get bigger and standard carriers scale back what they’re willing to write.”