Derecho 2020

On the morning of Aug. 10, 2020, as the wind howled, hundreds of thousands of people across the Corn Belt sheltered in their homes, waiting for the roaring winds to finally stop. The lights flickered and then the power went off for good, silencing the comfortable hum of appliances, leaving just the noise of the wind, rain, hail, and massive trees splintering and thundering to the ground.

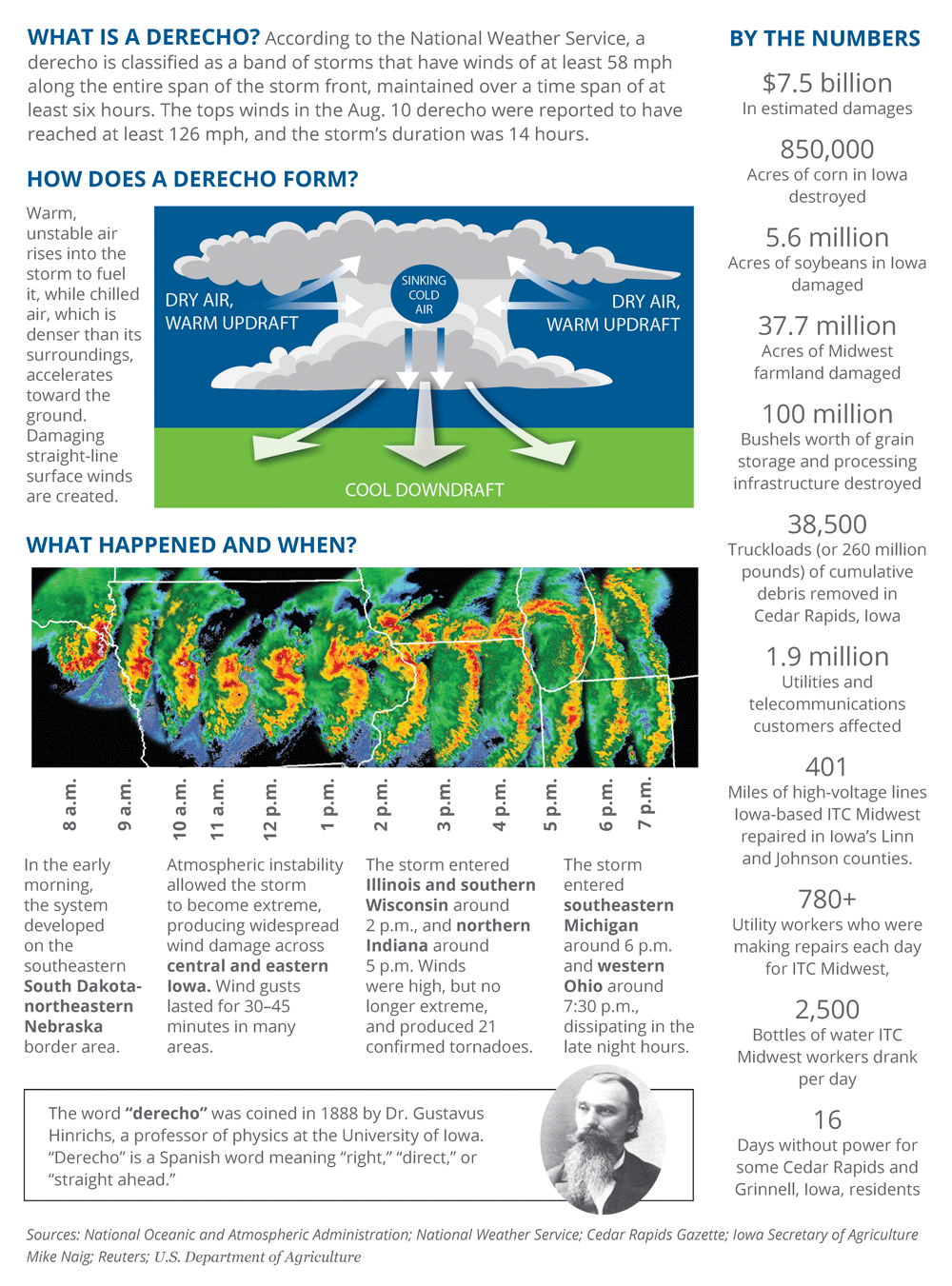

When people finally emerged from their homes, they would find themselves facing the aftermath of one of the most costly and damaging storms in the Midwest’s history. For many, it was the first time they had heard of a derecho, a storm of fast-moving, straight-line winds that can reach speeds up to 130 mph.

Hurricane winds, catastrophic loss

Over 14 hours, the storm ripped through 770 miles of farmland, homes, and communities, reaching wind speeds up to 126 mph according to one official report in Atkins, Iowa. More than a million people in Iowa and Illinois were left without power and thousands were left without homes. Four people, including three Iowans, died.

The derecho hit at least 10 million acres of corn and soybean crops, with over 850,000 acres of corn decimated. Thousands of trees were destroyed or damaged. Cedar Rapids, Iowa, lost over half its tree cover.

Compared to the 2008 EF-5 tornado that damaged over 600 homes in Parkersburg, Iowa, in 2008, the derecho only reached wind speeds similar to an EF-1 tornado. Though tornadoes are a more tightly contained destructive force, derechos by definition must have a wind-damage swath that extends more than 240 miles, according to the National Weather Service.

That’s why the Parkersburg storm resulted in a loss of $55 million (direct lines and reinsurance program combined) for Grinnell Mutual, whereas the claims incurred for the derecho added up to nearly $245 million, with an average claim of $19,000. And those numbers are just for Grinnell Mutual. Insurers across the region faced similar losses.

According to the National Oceanic and Atmospheric Administration, the derecho was second only to Hurricane Laura ($14 billion) in 2020 losses, exceeding $7.5 billion in total estimated damages.

Jeff Menary, president and CEO of Grinnell Mutual, called it a “Midwest hurricane.”

“This event was approximately five times larger than our biggest single occurrence loss event in Grinnell Mutual’s history,” he said. He noted that based on some current models, this type of damaging storm is only expected once every 280 years.

Stronger together after the derecho

Soon after the storm had passed, communities came together to help each other. Neighbors helped neighbors cut up and clear trees and debris, provided water and ice, and shared hot meals.

The city of Grinnell was hard-hit. Winds of around 100 mph left the city with power outages that lasted nearly two weeks for some residents. (Grinnell Mutual’s headquarters also lost power for several hours and sustained some damage.) Grinnell College reported having $2 million in structural and tree damage.

For local residents and employees, Grinnell Mutual helped sponsor a community dinner that served 1,200 people and cafeteria staff also set up a sack lunch drive-through, where company leaders helped hand out lunches to employees and their families.

And in keeping with the promises we make as an insurer, Grinnell Mutual mustered all hands to help our mutuals, agents, and policyholders.

Though many of the claims staff were impacted personally by the storm, Grinnell Mutual managed to stay on top of incoming claims. Vice President of Direct Claims Brian Delfino said that thanks to the help from many other departments, the company was able to continue providing our most essential services.

“We had a lot of people putting in a lot of hours and working weekends, especially our field adjusters on the commercial side. They were running seven days a week, working 12 to 14 hours a day for weeks.”

Kevin Kies, assistant vice president for Grinnell Re, said the reinsurance team helped mutuals set up automatic payments so they had the funding to pay their claims quickly. “The teamwork that came to the forefront and the willingness to help makes me proud to be a part of this team.”

The Grinnell Re team even made Grinnell Mutual’s office available to Bohemian Mutual Manager Joanne Wacha, who said that in her 38 years at the mutual, she had never seen a storm of this magnitude.

With storm claims coming in but no power or internet to process them, and dealing with damage to her own home, Wacha said that she felt very stressed. “You have holes in your house and you have water all over your floor, and glass everywhere — you feel like you don’t even know where to start.”

Derecho insurance claims pour in

As power, internet, and cellular service was restored, claims came pouring in. According to the Iowa Insurance Division, more than 200,000 Iowa policyholders have filed claims due to storm damage from the derecho, racking up more than $1.6 billion in insurance claims.

“This was the largest volume of claims that I’ve seen related to any storm,” Delfino said. “And it was also one of the biggest in the magnitude of damages to the area it impacted.”

Between its direct commercial and personal lines, Grinnell Mutual has received over 1,500 derecho-related claims. In total, the claims incurred to date are over $41 million.

On the reinsurance side, mutuals filed over 11,000 claims, for a total of about $230 million.

Vice President of Finance and Chief Financial Officer Chris Hansen said that while losses of this magnitude may have an impact on our surplus, in the long-term it’s just a blip. “We’re here to help put people back together, and there will be some years where you have underwriting losses because of things like this. As a strong, stable insurance company committed to serving our customers, we plan for ebbs and flows like this.”

Menary said that while many mutuals’ losses exceeded their surplus, they’ll be fine because of the reinsurance process. “It’s not just Grinnell Mutual taking care of this. It’s the entire reinsurance recovery process working across all levels to help each other out,” he said. “It’s the sole reason we exist: to keep our promises to those who are in need.”

Assistant Vice President of Reinsurance Doug Nauman said that for many mutuals, the biggest challenge was the massive number of claims in a 24-hour period. “With hailstorms, there is usually an influx of claims right away, but then they get dragged out. People will wait to look at their roofs a week, maybe even a month later. With many people working from home due to COVID-19, along with the severe storm damage, people were sending in claims right away.”

Menary said he was extremely proud of how employees dealt with the situation. “Grinnell Mutual has never had such an opportunity to assist so many people and to make a difference in their lives,” he said. “We had employees that didn’t have electricity or internet, and they were still making sure they could come in and take care of business.”

Preparing for tomorrow

The derecho was an unprecedented catastrophe in the Midwest. Going forward, many say they will prepare differently for any future disasters. For example, Menary said that Grinnell Mutual will be looking at recalculating prediction models for catastrophic weather.

Wacha said that for its part, Bohemian Mutual will be revisiting its disaster plan. “It’s simple things, like making sure you have enough toner for your printers or considering a building generator system for future outages,” she said. “Another thing I learned is to take advantage of available resources sooner.”

Kies and Delfino both agreed that looking into emergency staffing was something they would like to explore more in the future. “We learned that if all our internal call-center staff are unable to take calls because they’re without power, that we are dependent on outside help,” Delfino said. “But I would say for the most part, our process worked, and we came through pretty well.”

Kies said he would also like to think about how to get more staffing assistance to our mutual members. “How we get more manpower in an event like this to help with the general claims load will be another element to our disaster strategy.”

Menary hopes that the story of how the event was handled becomes part of the lore of Grinnell Mutual.

“I hope that 50 years from now, they’ll be talking about how Grinnell Mutual helped this family or that county mutual. I hope it becomes a keystone for how our organization operates as we grow and change in the future.”

Top photo courtesy of National Weather Service, Des Moines, Iowa office

Sources: The Cedar Rapids Gazette; The Des Moines Register; KCRG-TV (Cedar Rapids); Grinnell College; Tornado Talk; U.S. Department of Agriculture; National Oceanic and Atmospheric Administration; National Weather Service; Iowa Insurance Division.